Dogwifhat (WIF), the popular Solana-based meme coin has turned bearish as Bitcoin (BTC), the world’s largest cryptocurrency breached its crucial support level. Following this incident, the sentiment across the cryptocurrency landscape has significantly shifted towards a downtrend.

Dogwifhat Technical Analysis and Upcoming Levels

According to expert technical analysis, WIF has turned bearish as it breached its crucial support level of $2.10 and is about to close a daily candle below it. Based on recent price action and historical momentum, if the meme coin closes its daily candle below that support, there is a strong possibility of a significant 35% price decline in the coming days.

Currently, WIF is trading below the 200 Exponential Moving Average (EMA) on the daily time frame, indicating a downtrend. However, this bearish thesis will only hold if the meme coin closes its daily candle below the $1.97 level, otherwise, it may fail.

WIF’s Bearish Confirmation

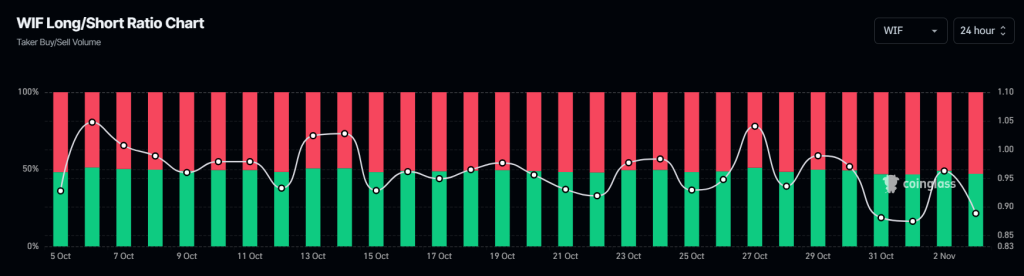

In addition to the technical analysis, on-chain metrics further support WIF’s negative outlook. According to the on-chain analytics firm Coinglass, the WIF long/short ratio currently stands at 0.88, indicating a strong bearish sentiment among traders.

Additionally, its open interest has dropped by 7.9% over the past 24 hours, indicating liquidation of traders’ positions as the price began to decline and traders hesitated to build new positions.

However, the falling open interest and a long/short ratio below 1 indicate weak bearish sentiment, as traders hold short positions, but no significant new short positions are forming.

Current Price Momentum

At press time, WIF is trading near $1.98 and has experienced a price decline of over 6.9% in the past 24 hours. During the same period, its trading volume increased by 13%, indicating traders’ and investors’ participation compared to the previous day.