The popular Solana-based meme coin Cat in a Dog World (MEW) is gaining significant attention from the crypto community due to its impressive performance with a surge of over 90% in recent days. Amid the rally, the sentiment of the meme coin has shifted from a downtrend to an uptrend.

Cat in a Dog World (MEW) Technical Analysis and Upcoming Levels

According to the expert technical analysis, MEW appears bullish as its significant rally has broken through a strong resistance level of $0.0085. However, in the past few days, it entered a consolidation zone but with today’s 17% upside momentum, it has broken out of the consolidation zone.

Based on the recent price action and historical momentum, there is a strong possibility it could soar significantly and reach a new all-time high in the coming days. However, this bullish price action pattern on the daily chart will not be confirmed until the asset closes a daily candle above the $0.0098 level.

Bullish On-Chain Metrics

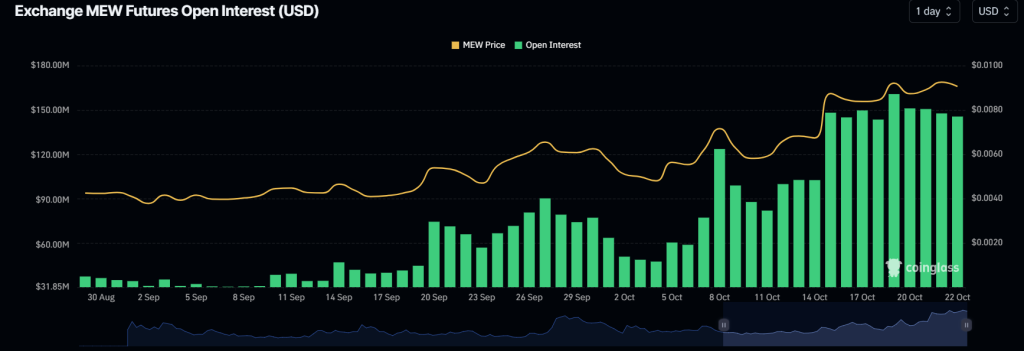

MEW’s positive outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, MEW’s Long/Short ratio currently stands at 1.05, indicating a bullish sentiment among traders. Additionally, its open interest jumped by 10% over the past 24 hours, reflecting growing trader participation amid the ongoing price rally.

Traders and investors often interpret rising open interest and a Long/Short ratio above 1 as signs of building long positions.

Combining these on-chain metrics with technical analysis, it appears that bulls are currently dominating the asset and could potentially support MEW in reaching a new all-time high in the coming days.

Current Price Momentum

At press time, MEW is trading near $0.0093 and has experienced a price surge of over 4.9% in the past 24 hours. During the same period, its trading volume spiked by 363%, indicating heightened participation from traders and investors, likely driven by the bullish price action.