Since Nov. 12, the Bitcoin market has entered a phase of significant profit-taking, with daily realized profits averaging around $5 billion — marking the highest profit levels in over a month, according to CryptoQuant data.

On Nov. 12, Bitcoin investors recorded $5.1 billion in profits as the asset traded near $88,000. By Nov. 13, profits declined slightly to $4.75 billion but rose again to $4.8 billion on Nov. 14, with Bitcoin’s price reaching a new all-time high above $93,000.

The activity comes after Bitcoin’s recent rally above $90,000, which was fueled by market optimism following President Donald Trump’s election win on Nov. 5. Many investors seem to be locking in gains after one of the most impressive runs in Bitcoin’s history.

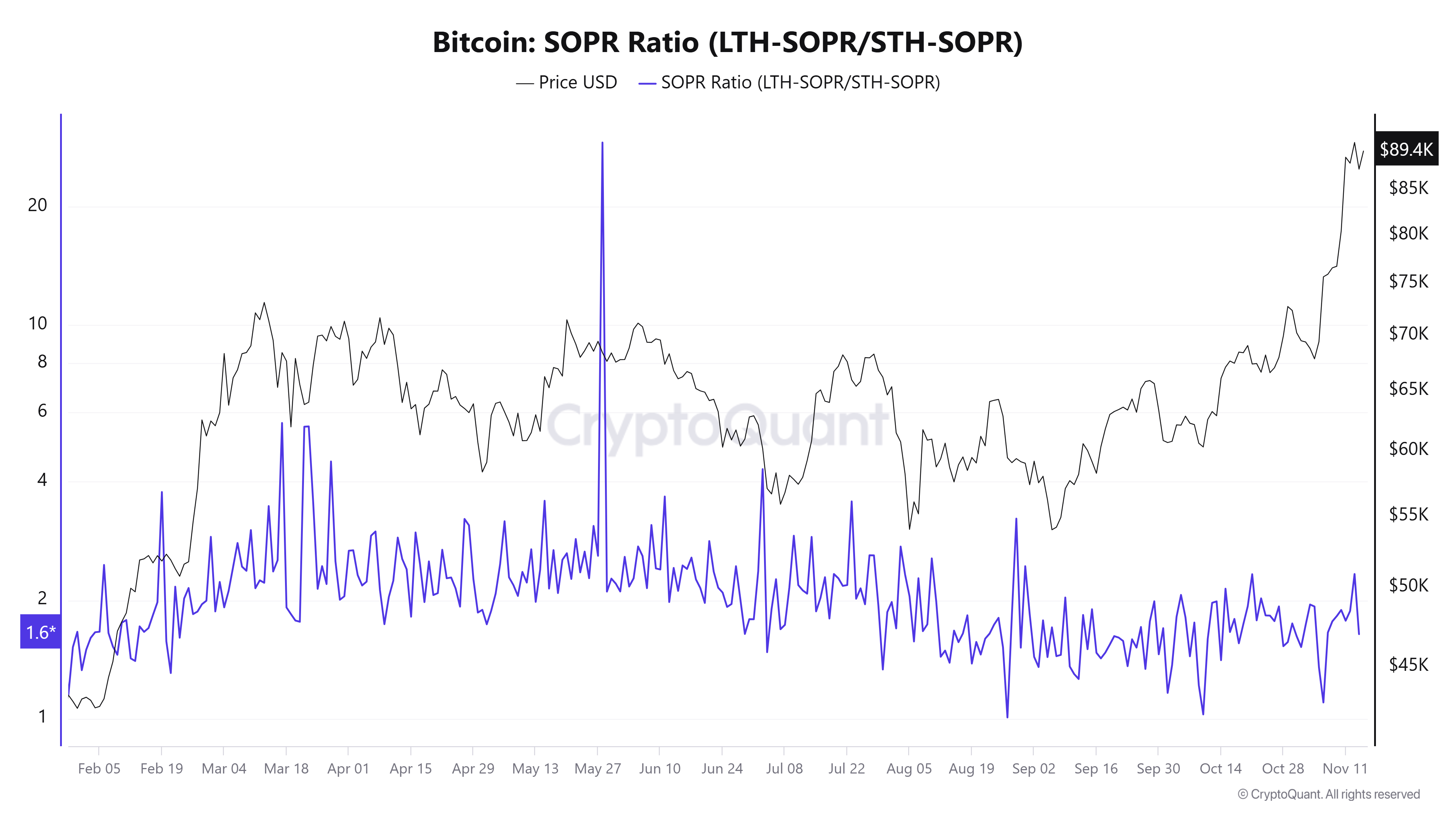

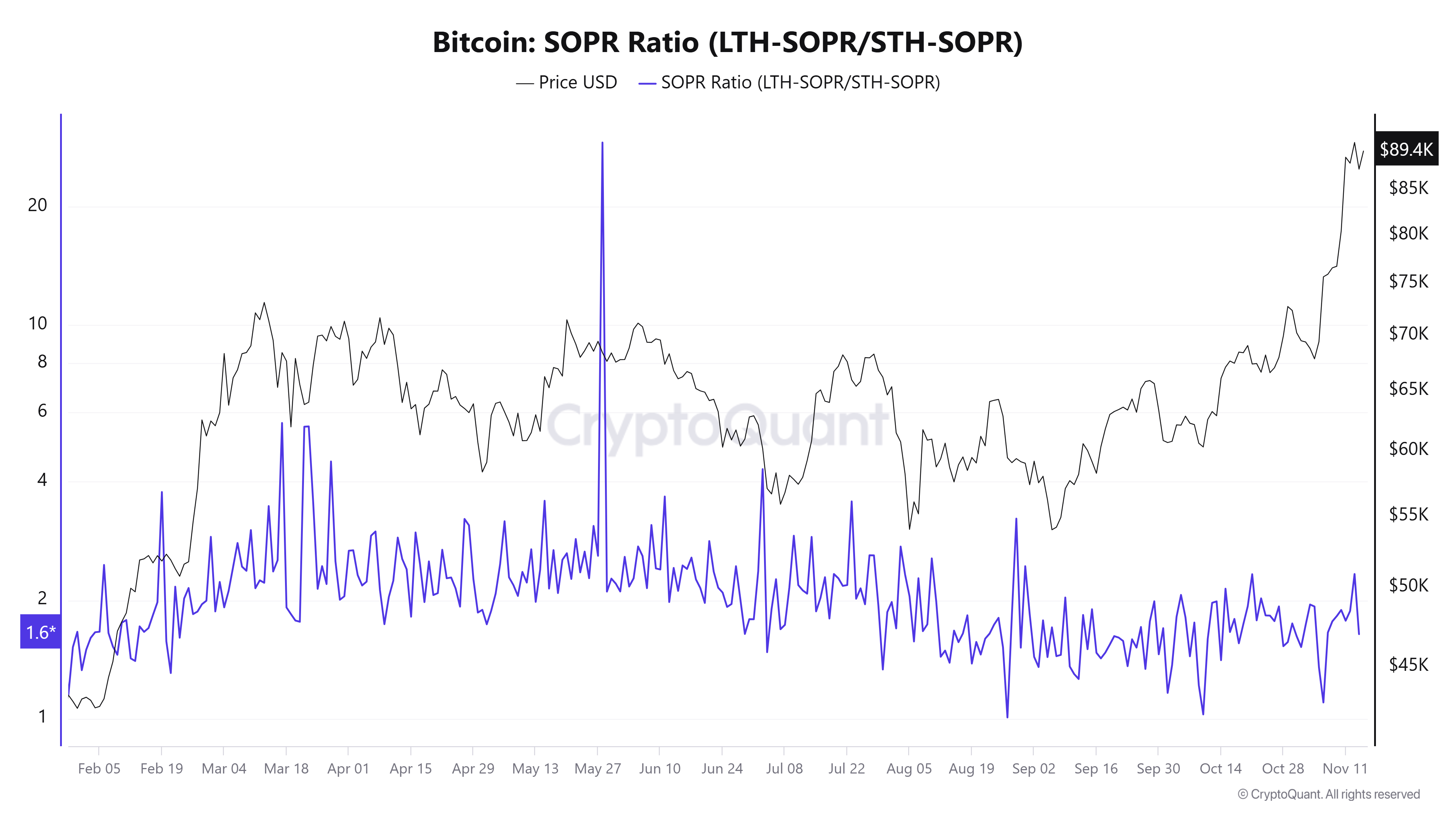

CryptoQuant’s spent output profit ratio (SOPR) data suggests long-term holders are leading the profit-taking. The SOPR metric, which measures realized profits among different investor groups, spiked sharply on Nov. 13, reaching its highest point since August.

Historically, such trends often indicate a potential price peak or the start of a consolidation phase.