Following an impressive 46% rally in recent days, Dogecoin (DOGE) has been making waves in the crypto landscape. It now appears that the meme coin is poised for another massive rally in the coming days, as it has formed a strong bullish price action pattern on its daily time frame.

Dogecoin (DOGE) Technical Analysis and Upcoming Levels

According to CoinPedia’s technical analysis, DOGE is on the verge of breaking out of a crucial resistance level, the high of March 2024. Based on recent price action and historical momentum, if DOGE breaches this level and closes a daily candle above it, there is a strong possibility it could soar by 50% to reach the $0.35 level in the coming days.

However, with the current market sentiment, this notable price rally could be easily possible. Currently, DOGE is trading above the 200 Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend.

DOGE’s Bullish On-Chain Metrics

Besides technical analysis, on-chain metrics further support DOGE’s bullish outlook. According to the on-chain analytics firm IntoTheBlock, DOGE’s on-chain metrics, such as Net Network Growth, In the Money, Concentration, and Large Transactions Volume, indicate a bullish signal.

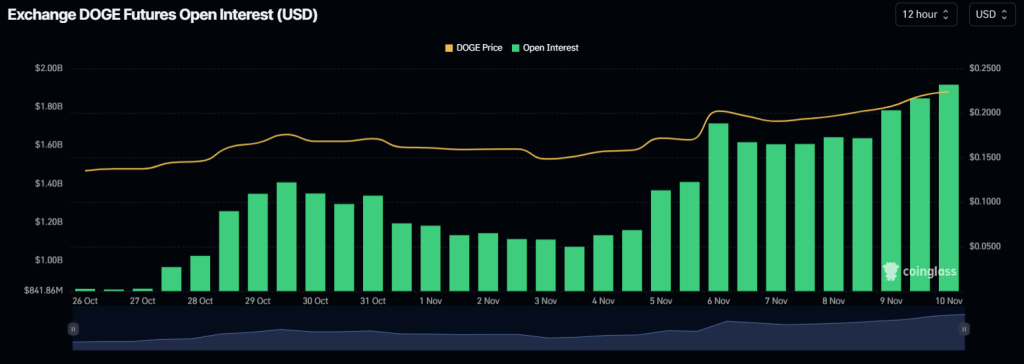

Besides this, traders are currently making notable bets on DOGE’s future contracts, as its open interest has jumped by 18% in the past 24 hours and 11% in the past four hours, according to the on-chain analytics firm Coinglass. Additionally, DOGE’s Long/Short ratio currently stands at 1.02, indicating bullish sentiment among traders.

By combining these on-chain metrics with technical analysis, it appears that bulls are currently dominating the asset and could support DOGE in its upcoming rally in the coming days.

Current Price Momentum

At press time, DOGE is trading near $0.227 and has experienced a price increase of over 14% in the past 24 hours. During the same period, its trading volume rose by 23%, indicating heightened participation from traders amid a potential upside rally.