The founder of Aave downplayed Solana’s Kamino during an argument with the president of the Solana Foundation and the co-founder of Solana Labs about decentralized money markets on X.

Alex Svanevik, founder of Nansen, questioned the absence of Aave on Solana, which currently boasts Kamino as its largest money market protocol.

According to DefiLlama data, Aave is available in 13 blockchains as of press time and has amassed nearly $19.6 billion in total value locked (TVL).

Kyle Samani, partner at venture capital fund Multicoin Capital, commented Kamino, which is also a money market.

Svanevik replied that Aave’s TVL is nearly 10x larger than Kamino’s, and users would prefer the former if they could use it on Solana. Kamino is the third-largest application on Solana, with over $2.3 billion in TVL.

Lily Liu, president of the Solana Foundation, said:

“But kamino is a better product

Plus metrics today are not metrics tomorrow.”

Considering her role as one of the most important figures in the Solana ecosystem, Liu’s reply offended some enthusiasts.

Mats Olsen, co-founder of Dune, suggested that opening Solana to Aave would be more appropriate than comparing applications. Svanevik agreed with Olsen’s reply.

Stani Kulechov, founder of Aave’s mother group Avara, commented on Liu’s response:

“The state of Solana DeFi:

– Copycat Aave’s old tech

– Slap a half baked UI

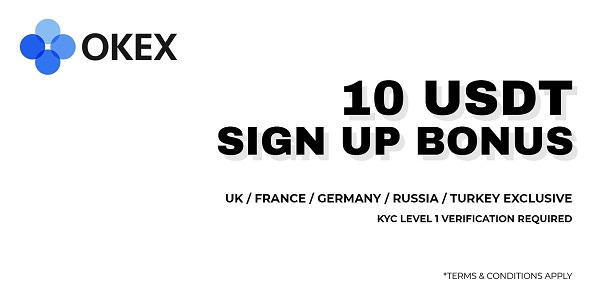

– Restrict also UK users from using it

– Solana foundation president calls it a better product

Expect people to buy the bluff.”

Liu explained her potential bias as the Solana Foundation cheers for “homegrown” applications. She also called Kulechov’s answer an “outburst” to his followers.

Anatoly Yakovenko, co-founder of Solana Labs, joined the discussion comparing the applications’ revenue instead of TVL.

Although Aave has over eight times Kamino’s TVL, the Solana-based money market registered $52 million in annualized revenue compared to Aave’s $126.3 million.

Yakovenko added:

“TVL is a cost of you can’t squeeze revenue out of it.”

Kulechov stated that the revenue difference occurs because Kamino takes a “bigger cut” from users’ fees. He compared the USD Coin (USDC) Reserve Factor of both platforms, with Kamino taking 5% more than Aave.

The Aave founder added:

“I guess there isn’t enough competition yet on Solana and users are paying price for that.”

While Aave has the largest liquidity in the money market sector, recently processing $210 million in liquidations after the Feb. 2 crash, Kamino added tools to its interface to help us leverage their borrowing positions.

Mentioned in this article